- Shrewd Investor

- Posts

- 💸 #0006 - How the Wealthy Save Millions in Advisor Fees—You Can Too

💸 #0006 - How the Wealthy Save Millions in Advisor Fees—You Can Too

Uncover the secrets that save the wealthy millions in fees.

Are You One of the Millions Losing 35% to Advisor Fees?

If you’re paying 1% per year, over 30 years, that compounds to 35% over the next three decades.

This week, we tackle wealth management basics, from avoiding the high cost of advisor fees to lessons from the Rothschilds, who pioneered the first family office.

Explore China’s gold restrictions, high-net-worth investor trends, and a booming risk-on market led by Bitcoin and the S&P 500.

In today’s issue:

Market Minute - Risk assets are booming…

Deep Dive - How one reader can save $22MM in fees…

Wealth Hack - A little-known trick used by the wealthy…

Brain Food - The Rothschild’s innovation…

First time reading? Sign up at https://shrewdinvestor.com

WEEKLY WISDOM

“One of the astute things I was taught is that on average, the average investor does average before fees, and below average after fees.”

Howard Marks

ENGAGING IDEAS

Chinese Banks Blocking Gold…

China's banks are blocking physical gold investments, tightening control on capital outflows. This could cool global gold demand and pressure prices—another sign of Beijing’s grip on wealth. By restricting clients from investing in gold products, Beijing tightens its grip on domestic wealth while potentially cooling global demand. It’s a bold step that underscores the government’s priority: keeping capital locked inside its borders.

High-Net-Worth Pile into Privates…

High-net-worth investors are prioritizing private equity and venture capital over other private assets, with 63% favoring PE and 52% leaning into VC, according to a recent survey. Firms like Ares Management and HG are capitalizing on this trend, forging alliances with private banks to capture the growing appetite. The focus? Diversification, outsized returns, and alignment with personal values like sustainability.

Pending Home Sales Up…

Pending home sales rose 2% in October, marking the third monthly gain, but this reflects buyers scrambling against 7%+ mortgage rates, not market strength. Tight inventory persists as sellers cling to low-rate mortgages, leaving fewer homes to fight over. The result? Rising prices despite worsening affordability. This isn’t a rally—it’s a scramble.

MARKET MINUTE

Risk Assets Leading the Charge

With the election behind us, the markets are surging, prompting some to predict a pullback or even a blow-off top before a major crash. But what’s really happening beneath the surface?

Short-Term Trend | Medium-term Trend | Long-term Trend | |

|---|---|---|---|

UP | UP | UP | |

UP | UP | UP | |

UP | UP | UP | |

UP | UP | UP | |

DOWN | UP | UP | |

DOWN | DOWN | DOWN |

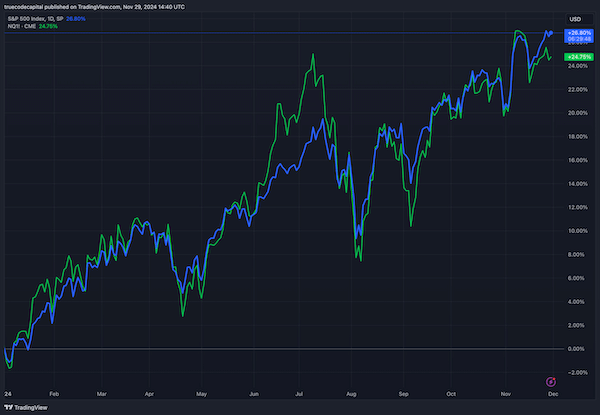

Speculative investments are thriving, with the Nasdaq, S&P 500, and Bitcoin all trending sharply upward. These risk assets are clearly leading the charge.

Even the recent pullback in the Nasdaq at the end of October looks less like a crash and more like a natural correction to its short-term trendlines—an expected and healthy occurrence in robust markets.

S&P 500 and Nasdaq Booming in 2024 - tradingview.com

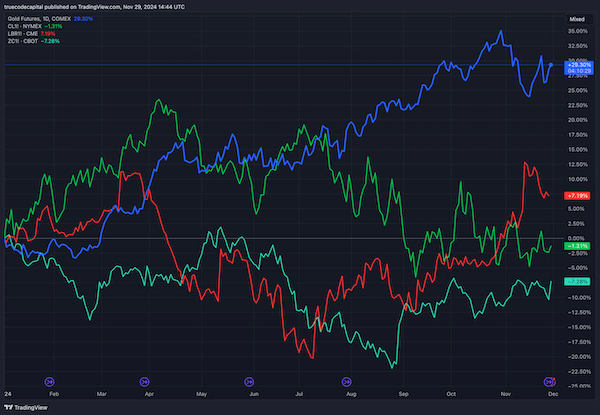

More tellingly, defensive commodities have been either declining or moving sideways since Q2 of 2024, signaling a lack of concern among investors.

Commodities Stalled in 2024 - tradingview.com

Despite the cautionary narratives from pundits, the data paints a clear picture: this market is strong, and investors are firmly in risk-on mode.

How do you like this sectionof this month's issue? |

DEEP DIVE

Am I Getting Ripped Off by My Advisor? The $22MM Question

One reader with a $15MM portfolio pays their advisor 1% annually and wants to know if that is too much. At first glance, this fee might seem reasonable—but over 30 years, it could cost him $22.4 million in lost wealth.

How? That 1% fee compounds alongside portfolio growth, creating a drag on returns that grows exponentially over time.

In dollars, this advisor will collect $150,000 in fees during the first year, regardless of whether the portfolio makes a return. By year 30, the investor will retire with 35% less wealth than someone who avoided the fee entirely.

Put another way: the fees paid over 30 years would exceed the portfolio’s current value. This isn’t just a 1% question—it’s a $22MM problem.

Year | Portfolio Value (No Fees) | Portfolio Value (Net of Fees) | Difference (Lost to Fees) |

|---|---|---|---|

0 | $ 15,000,000.00 | $ 15,000,000.00 | $ - |

5 | $ 20,073,383.66 | $ 19,089,588.13 | $ 983,795.53 |

10 | $ 26,862,715.45 | $ 24,294,158.34 | $ 2,568,557.11 |

15 | $ 35,948,372.90 | $ 30,917,698.45 | $ 5,030,674.45 |

20 | $ 48,107,032.08 | $ 39,347,075.29 | $ 8,759,956.80 |

25 | $ 64,378,060.80 | $ 50,074,630.76 | $ 14,303,430.03 |

30 | $ 86,152,367.59 | $ 63,726,938.48 | $ 22,425,429.12 |

The Hidden Cost of Fees

Advisors often downplay fees, relying on the idea that “1% sounds small.” But think of it in dollars, not percentages.

If your advisor matches market returns but charges $10,000 a year on a $1MM portfolio, ask yourself: is the financial advice worth the price?

For many, especially with simple financial needs, the answer is no.

10 Ways to Avoid the Wealth Drain

Treat Your Advisor Like an Employee

Many advisors try to blur the line between service provider and friend. Don’t let them. You are the one paying, so they work for you. It is up to you to monitor and manage them to make sure you get the best deal.

Consider Flat Fees or Hourly Advice

Pay only for what you need, when you need it. A flat $15,000 annual fee could save millions compared to percentage-based fees on large portfolios.

Adopt a Hybrid Approach

Work with an advisor for big-picture planning and more complex investments, but handle core portfolio management yourself with low-cost index funds, ETFs, or robo-advisors.

Invest in Low-Cost Funds

Index funds and ETFs with expense ratios under 0.10% are an excellent alternative to expensive, actively managed funds and you can buy them in any brokerage account with very little fees.

Negotiate or Benchmark Your Advisor’s Performance

Compare their results to a target-date fund or broad market index. If they’re not adding value beyond market returns, reconsider their services or negotiate a better fee structure.

Beware of Hidden Costs

Watch out for Assets Under Advisory (AUA) fees, which apply even to assets your advisor doesn’t manage directly, such as 401(k)s. These fees can result in double-dipping without adding value.

Remember You’re Not Locked In

You can transfer your investments to another advisor or brokerage at any time without incurring tax penalties. These are your investments, not theirs—don’t let inertia keep you in a bad deal.

Remember, You’re in Control

Your investments are yours, and you can move to another advisor or brokerage at any time without incurring tax penalties.

Avoid Large Brokerage Firms

Big firms connected to banks often employ less experienced advisors and rely on high-volume sales rather than personalized service. Independent advisors can often provide better service and access to the same investments for lower fees.

Consolidate Accounts for Lower Fees

Many advisors offer tiered pricing based on portfolio size, so consolidating your accounts could qualify you for lower rates. For example, rolling over an old 401(k) or combining joint accounts with your spouse could reduce your overall fee percentage.

How do you like this sectionof this month's issue? |

WEALTH HACK

How the Wealthy Avoid Paying Advisor Fees

For wealthy investors, paying 1% in advisor fees can quickly become a huge expense. On a $100MM portfolio, that’s $1 million every year—whether or not the advisor adds value. How do the ultra-wealthy avoid these steep fees while still managing their financial needs?

Enter the Family Office

Wealthy families often set up family offices to handle their finances. These are private organizations that manage everything from investments to tax planning and estate strategies.

A family office integrates all aspects of wealth management, providing better service and often leading to better returns.

Because the family is in charge, the Family Office can hire or develop expertise in specific areas of investment like real estate or private equity that traditional financial advisors cannot match.

What About Multi-Family Offices (MFOs)?

Some firms advertise themselves as multi-family offices (MFOs), claiming to provide family office services to multiple clients for those whose portfolios aren’t quite large enough for a single family office yet.

While these can be valuable, many MFOs are simply rebranded financial advisory firms offering bundled services like tax preparation and bookkeeping alongside traditional investment management.

MFOs often charge steep fees, sometimes higher than 1% annually.

Unless you negotiate aggressively and receive clear, measurable value—like tax savings or exclusive investment opportunities—they might not be worth the cost.

How do you like this sectionof this month's issue? |

BRAIN FOOD

First Family Office - The Rothschild Family

The Rothschild family pioneered the concept of the modern family office, creating a centralized system for managing wealth and maintaining unity across generations.

Their innovative approach has influenced high-net-worth families worldwide.

The Rise of the Rothschild Dynasty

Mayer Amschel Rothschild (1744–1812), a coin dealer in Frankfurt, Germany, built the foundation of the family’s fortune. He established a network by stationing his five sons in Europe’s major financial centers: Frankfurt, London, Paris, Vienna, and Naples.

This strategy allowed the family to dominate international finance, including sovereign loans and currency exchanges.

Their big breakthrough came during the Napoleonic Wars (1803–1815), when Nathan Mayer Rothschild in London financed Britain’s military campaigns.

The family’s ability to move funds across borders quickly cemented their reputation, making them the leading financiers of 19th-century Europe.

The First Family Office

As their wealth grew, the Rothschilds formalized their operations into a family office—one of the earliest known. Unlike external advisors, their office comprised trusted professionals, including accountants, lawyers, and investment managers. Key functions of the family office included:

Diversified Investments: Managing assets in banking, railroads, real estate, and commodities.

Risk Management: Ensuring the family’s financial security through geographic diversification.

Philanthropic Oversight: Coordinating charitable efforts, such as funding cultural institutions and scientific research.

This centralized structure ensured the family’s wealth remained protected and optimized over generations.

Governance and Family Structure

The Rothschilds understood the importance of maintaining unity. Mayer Amschel Rothschild established guiding principles:

Family Control: Wealth stayed within the family, reinforced through intermarriage among cousins.

Centralized Decisions: Key financial and strategic matters were decided collectively.

Confidentiality: The family’s dealings were kept private, a hallmark of their operations.

Regular family meetings were essential to their governance model. These gatherings allowed for:

Strategic Planning: Reviewing investments and setting goals.

Conflict Resolution: Resolving disputes to maintain harmony.

Succession Planning: Preparing younger generations for leadership roles.

By fostering open communication and shared decision-making, the Rothschilds created a cohesive family structure.

Legacy of the Rothschild Family Office

By the mid-19th century, the Rothschilds controlled an estimated £4 billion in today’s terms, making them the wealthiest family in history.

Their family office preserved and expanded their wealth across generations, influencing modern family office practices. Lessons from their approach include:

Centralization: Streamlining financial management through a single entity.

Long-Term Vision: Prioritizing intergenerational wealth and governance.

Private Governance: Regular family meetings to align goals and prevent disputes.

The Rothschild model remains the gold standard for family offices, inspiring structures that today manage trillions of dollars globally.

Their innovation in wealth management and governance continues to shape how wealthy families secure and grow their legacies.

How do you like this sectionof this month's issue? |

The content provided in this newsletter is for informational purposes only and should not be considered as specific advice for any specific individual. The information is prepared by knowledgeable individuals and is not written by certified tax professionals or investment advisors. For personalized advice tailored to your unique financial situation, consult with a qualified tax professional, financial advisor, or attorney.

STILL WANT MORE?

How to Get a Deep Dive?

Want honest feedback on your investment strategy? Submit your portfolio or question to Shrewd Investor and get expert insights in our weekly 'DEEP DIVE' feature.

Sponsorship?

If you are interested in sponsoring a future issue, send an email to [email protected]

How was the newsletter? |