- Shrewd Investor

- Posts

- 💸 #0007 - Secrets to Making Your Wealth Last for Life

💸 #0007 - Secrets to Making Your Wealth Last for Life

Your money should keep working, even when you’re not. Here’s how.

Retirement is the ultimate financial puzzle:

Can your portfolio last forever?

This week’s deep dive pits the 4% rule against the allure of a guaranteed annuity.

Discover the pros, cons, and hidden risks of each strategy—and decide which path you’d take.

In today’s issue:

Quick Reads - Billionaires paradise Monaco and more…

Market Minute - Why Palantir is crushing the S&P 500…

Deep Dive - How one reader can spend more in retirement…

First time reading? Sign up at https://shrewdinvestor.com

WEEKLY WISDOM

"The biggest risk in retirement is outliving your money."

– Jane Bryant Quinn

ENGAGING IDEAS

Bitcoin Breaks $100K: Game On…

Bitcoin has shattered the $100,000 barrier, fueled by President-elect Donald Trump's pro-crypto stance and the nomination of blockchain advocate Paul Atkins as SEC chair. This surge signals a seismic shift in the financial landscape, with Bitcoin's market cap nearing $2 trillion. Dive into the full article to explore the factors driving this unprecedented rally and what it means for the future of finance.

Monaco’s Billionaire Paradise Revealed…

Monaco has unveiled Mareterra, a six-hectare district reclaimed from the sea, featuring 100 apartments priced over $100,000 per square meter and villas reportedly sold for around $200 million each. This development, designed by renowned architects like Renzo Piano and Lord Foster, aims to blend luxury with environmental sustainability, though it has faced criticism from ecologists.

AI Sparks Climate Tech Revival…

Climate tech investments have dipped below pre-2019 levels, but savvy investors are finding gold in AI-driven solutions and adaptation technologies. With the U.S. market buoyed by supportive policies, now's the time to explore where smart money is heading in the fight against climate change.

MARKET MINUTE

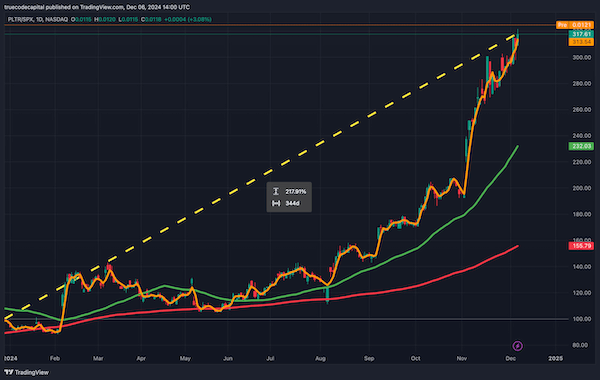

Palantir Crushes the S&P 500 in 2024

Palantir Technologies, the data analytics and artificial intelligence powerhouse, delivered a jaw-dropping performance in 2024, outpacing the S&P 500 by an astounding 218%.

While the broader index rose by an astounding 28%, Palantir’s stock soared even higher, making it one of the most successful large-cap tech performers of the year.

Here’s what fueled the company’s incredible growth:

Revenue Growth: Palantir achieved $2.5 billion in annual revenue, marking a 35% year-over-year increase, driven by expanding adoption of its AI-driven software solutions.

Government Contracts: The company secured major new deals, including a $1 billion U.S. Department of Defense contract and a $500 million multi-year contract with NATO, underscoring its dominance in defense and intelligence applications.

Commercial Expansion: Palantir’s revenue from the commercial sector grew by 45%, with notable wins in the healthcare, energy, and logistics industries. Partnerships with firms like Pfizer, BP, and Caterpillar highlighted its increasing presence outside the public sector.

AI Leadership: Palantir’s Foundry and Gotham platforms capitalized on the surge in artificial intelligence adoption. Its Apollo platform enabled seamless AI deployment, earning it accolades as a market leader in operational AI.

Profitability: The company posted $400 million in free cash flow, up 50% year-over-year, solidifying its financial stability while continuing to invest in innovation.

Palantir’s meteoric rise highlights its ability to blend cutting-edge technology with real-world applications for state-level clients.

As the company pushes boundaries in AI and data analytics, its 2024 success sets a high bar for 2025, but momentum is on their side.

How do you like this sectionof this month's issue? |

DEEP DIVE

Can I Spend $40,000 a Year Forever? Comparing the 4% Rule to a 4% Annuity

Another reader recently reached out with a question that gets right to the heart of retirement planning: "I’m in my early 40s, have a $1 million portfolio, and my brokerage is offering a guaranteed 4% annuity. Can I really spend $40,000 a year forever with this portfolio—or should I take the annuity?"

It’s a great question. On the surface, the idea of guaranteed income for life sounds perfect, especially if you’re looking to retire early. But there’s more to the story.

Unpacking the 4% Rule?

The 4% rule is a retirement planning guideline that dates back to 1994, when a financial planner named William Bengen set out to answer a similar question: How much can you safely withdraw from your portfolio each year without running out of money?

Bengen’s research looked at historical U.S. stock and bond returns, running simulations to find the “worst-case scenario.”

He discovered that if a retiree withdrew 4% of their portfolio in the first year, then adjusted that amount annually for inflation, the money would likely last for at least 30 years—even during challenging economic periods.

The rule quickly became a cornerstone of retirement planning, offering a simple, reassuring formula for retirees.

How Has the 4% Rule Held Up?

Over the years, the 4% rule has been put to the test in all kinds of economic conditions. It worked well during periods like the post-WWII economic boom and the 1990s bull market.

The problem was it faced challenges in tougher times, such as the Great Depression, the stagflation of the 1970s, and more recently, the 2008 financial crisis and the COVID-19 pandemic.

Critics point out that the rule makes several assumptions:

A 60/40 stock-bond portfolio, which might not suit everyone’s psychological risk tolerance.

Limited diversification, focusing only on U.S. markets.

Fixed spending patterns, ignoring that retirees might spend more in some years and less in others.

Ignores big purchases like weddings, once-in-a-lifetime vacations, or buying a second home.

For someone in their early 40s, there’s another wrinkle: a longer retirement horizon.

If you’re planning for 40 or even 50 years, the risk of running out of money increases.

Now Let’s Look at the Annuity

A 4% annuity is essentially a contract with an insurance company.

You hand over your $1 million, and in return, they pay you $40,000 a year for the rest of your life.

Sounds great, right? No market worries, no calculations, just guaranteed income.

But, as with anything that sounds too good to be true, there’s a catch. Several, actually.

The Pros and Cons of a 4% Annuity

Advantages:

Guaranteed Income for Life: You’ll never outlive your money (longevity risk).

Peace of Mind: No need to worry about market crashes (sequence of returns risk).

Simplicity: The income is predictable and steady.

Drawbacks:

Inflation Risk: Unless the annuity is inflation-adjusted (and most aren’t), your $40,000 will lose purchasing power every year. After 20 years, it might feel more like $20,000.

High Fees and Lack of Liquidity: Once you buy an annuity, that money is locked up. Need extra cash for a medical emergency or a big trip? Too bad…

No Growth Potential: Unlike a diversified portfolio, an annuity doesn’t allow your money to grow over time.

For someone in their early 40s, inflation is a major concern.

Over a 40-year retirement, even mild inflation can eat away at your purchasing power. If your spending needs grow—say, because of healthcare costs or travel—you could find yourself falling short.

Big Decision Markets vs. Annuities: What Would You Choose?

Let’s break it down with a $1 million portfolio.

💡 Using the 4% rule, you could withdraw $40,000 in year one, then increase that amount each year to keep up with inflation.

💡 The catch? To make the rule work, you’d need to invest at least 50–75% of your portfolio in stocks, which not everyone is comfortable with.

💡 Markets can be volatile, and some years your portfolio balance will drop.

💡 With an annuity, you avoid market risk, but you give up flexibility.

💡 Once you lock in that $40,000 income, it’s fixed.

💡 If inflation rises or your spending needs change, there’s no room to adjust.

What’s the Right Choice?

The answer depends on your priorities and financial situation. Here are some things to consider:

Your Spending Needs: Are your high-spending years now, with kids at home and big family vacations? Or do you expect your costs to stay stable?

Flexibility vs. Security: Do you want the ability to adjust your spending or are you more comfortable with a predictable income?

How Will You Spend Your Time? Retirement isn’t just about money. If managing a portfolio sounds stressful, an annuity might be worth considering. But if you enjoy staying engaged with the markets, the 4% rule offers more opportunities for growth.

A Final Thought on the 4% Rule

Despite its critics, the 4% rule has stood the test of time for many retirees.

It’s not perfect, but it provides a solid starting point.

Just remember: it’s based on averages and probabilities, not guarantees. Some retirees have seen their portfolios grow using the rule, while others have faced depletion.

Investing isn’t just math; it’s emotional, too.

If you’re not comfortable riding out market downturns, even the best withdrawal strategy won’t help you sleep at night.

As for the annuity, it’s not inherently bad—it just comes with trade-offs.

If guaranteed income is your top priority and you’re willing to accept the risks of inflation and lack of liquidity, it might be worth considering.

But if you want flexibility and growth potential, sticking with a well-diversified portfolio may be the better choice.

Which would you choose? An annuity’s guaranteed income or the potential growth of the 4% rule? Let me know—I’d love to hear your thoughts! Reply with ANNUITY or MARKETS and I’ll post the results next week.

How do you like this sectionof this month's issue? |

The content provided in this newsletter is for informational purposes only and should not be considered as specific advice for any specific individual. The information is prepared by knowledgeable individuals and is not written by certified tax professionals or investment advisors. For personalized advice tailored to your unique financial situation, consult with a qualified tax professional, financial advisor, or attorney.

STILL WANT MORE?

How to Get a Deep Dive?

Want honest feedback on your investment strategy? Submit your portfolio or question to Shrewd Investor and get expert insights in our weekly 'DEEP DIVE' feature.

Sponsorship?

If you are interested in sponsoring a future issue, send an email to [email protected]

How was the newsletter? |