- Shrewd Investor

- Posts

- 💸 #0027 - The Smart Money Is In Solar: Here's Why You Should Pay Attention

💸 #0027 - The Smart Money Is In Solar: Here's Why You Should Pay Attention

Prepare for market volatility after Fed meeting — and discover how to shield your wealth with 14% contractual returns.

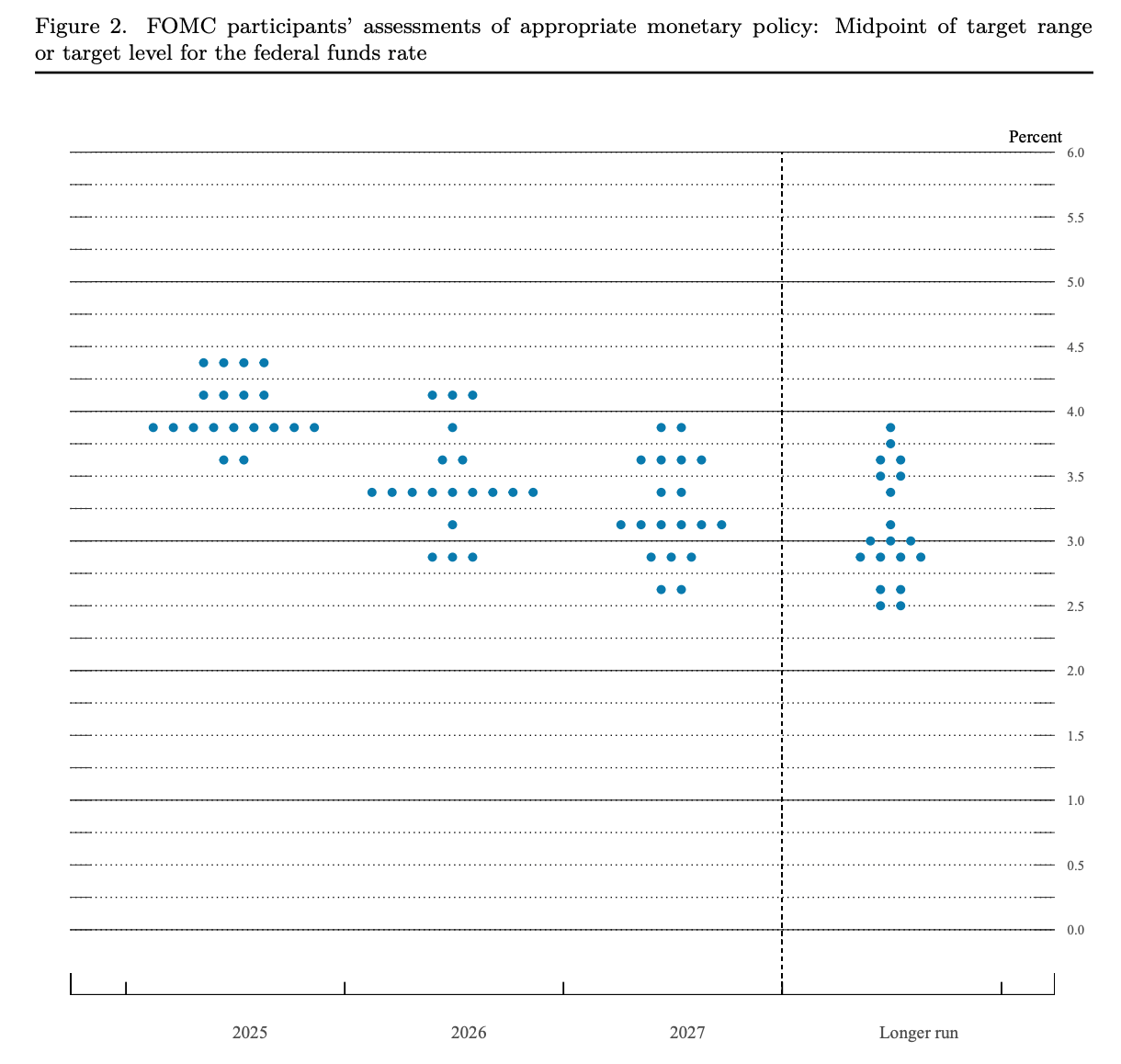

FED WATCH: What Will Powell Say Wednesday?

Markets Ready to Move - But Which Way?

All eyes are on the Fed this week. Everyone expects rates to stay put, but what Powell says about future plans is what really matters.

After weeks of tariff news overload, investors need new direction. The market sits right under key resistance levels (20-week and 50-week moving averages). If the Fed shows any sign of easing up on their tough stance, stocks could break through and surge upward.

I love this setup! Once the market picks a direction after Powell speaks, the move could be explosive either way.

ALSO IN THIS ISSUE:

THE INVESTMENT YOU'RE MISSING: Commercial Solar Profits

While everyone watches the Fed, smart money is quietly flowing into commercial solar projects earning 12-18% returns. These investments offer:

Steady income backed by long-term contracts

Major tax breaks (30% federal credit)

Protection from stock market swings

One doctor cut his taxes by $127,000 last year using this strategy. But the window for maximum tax benefits is closing soon.

Talk soon,

Josh

In today’s issue:

Weekly Wisdom - Peter Lynch’s warning rings true!

Market Minute - Markets are holding their breath waiting for Powell…

Deep Dive - Shining a light on higher returns and lower taxes…

First time reading? Sign up at https://shrewdinvestor.com

WISDOM

“Know what you own, and know why you own it.”

DEEP DIVE

The Investment You're Overlooking — But Shouldn't

Where Does Commercial Solar Fit?

You've seen the headlines.

You know the renewable sector is booming.

But here’s the real question:

Are you investing in commercial solar, or just watching from the sidelines?

While many investors recognize the rise of clean energy, most still assume solar belongs in tech startups or environmental passion projects.

The reality? It’s quietly becoming one of the most stable, high-performing alternative assets available today.

Last year, I guided a client into a $2.4 million commercial solar project.

Today, that investment generates a 14% annual return, outperforming its traditional portfolio and with far less volatility.

After 25 years in hedge fund management, I can confidently tell you:

Commercial solar is where smart capital is quietly flowing, and it’s time you considered why.

Why the Smartest Investors Are Allocating 10-15% to Commercial Solar

The reason is simple: commercial solar offers what few other investments can:

Predictable, contract-backed cash flow

Powerful tax advantages

Income streams are insulated from stock market swings

In an increasingly uncertain economic environment, these factors have positioned solar not just as an alternative investment but as a strategy for future-proofing wealth and building a lasting financial legacy.

Unlike speculative bets driven by sentiment, solar is a tangible, productive asset generating real, measurable income.

What Makes Commercial Solar Different (And Why It Should Be On Your Radar)

So, what exactly sets solar apart from other asset classes?

Investing in commercial solar doesn’t depend on stock price fluctuations.

Instead, you’re securing long-term, contractually guaranteed income through Power Purchase Agreements (PPAs), legally binding contracts where utilities, businesses, or municipalities agree to buy the clean energy your project produces at predetermined rates for 15 to 30 years.

(For example, a local utility might commit to purchasing all the power generated by your project for the next two decades, ensuring steady revenue.)

Why this matters:

Reliable Cash Flow: Monthly income from energy sales, locked in by contract.

Exceptional Tax Benefits:

30% Federal Investment Tax Credit (ITC)

Accelerated Depreciation (MACRS): Deduct up to 40% of the system's cost in year one.

"After implementing the solar tax strategy we discussed, I reduced my federal tax liability by $127,000 last year alone," shared Michael D., a physician client who invested in a mid-sized commercial installation.

How the Numbers Work: Turning Sunshine Into Strong Returns

So, how does this translate financially for the typical investor?

Example: $500,000 Solar Investment

$150,000 in Federal Tax Credits (30% ITC)

Additional first-year depreciation benefits

5-8 years to pay off the system

10-25 years of nearly pure profit from energy sales after payback

Internal rates of return (IRR) between 12-18% are common across well-structured projects, often outperforming both the stock market and traditional real estate while providing a level of consistency that is increasingly hard to find elsewhere.

While these returns are compelling, a thoughtful approach requires clear visibility into the associated risks.

What About the Risks? (Here’s How We Manage Them)

No investment is without risk, but understanding and addressing those risks properly is what separates successful strategies from speculative plays.

One key factor to consider is regulatory change.

While the current environment is highly supportive of clean energy, incentives could shift with future policy decisions.

To mitigate this, each project is structured to lock in today’s available tax benefits, securing your position before any potential adjustments occur.

There’s also the matter of project performance. Solar energy production can be influenced by weather conditions, site variables, and system upkeep.

Finally, commercial solar, like real estate, is a long-term, illiquid investment.

Capital is typically committed for seven years or more, making thoughtful financial planning essential.

Your role is to ensure this commitment aligns comfortably with your broader investment goals, so your portfolio remains balanced and accessible where it needs to be.

Through disciplined due diligence, conservative modeling, and proactive risk management, these challenges are kept in check, allowing the strength of the opportunity to shine.

Why Act Now? The Window for Maximum Tax Benefits Is Closing

Accredited investors earning over $200,000 annually or with a net worth exceeding $1 million are well-positioned to benefit from this opportunity.

But here’s the catch:

The 30% federal tax credit that makes solar so compelling is scheduled to step down in the coming years. Waiting could mean leaving six figures in tax advantages on the table.

One investor who delayed participation shared with me afterward:

"My only regret was not entering the market sooner—the tax savings alone would have paid for my family's vacation home."

P.S.

If you’d like us to break down your portfolio or ask a question, submit yours here: https://shrewdinvestor.com/roastme

If you are interested in sponsoring a future issue, send an email to: [email protected]

How do you like this sectionof this month's issue? |

The content provided in this newsletter is for informational purposes only and should not be considered as specific advice for any specific individual. The information is prepared by knowledgeable individuals and is not written by certified tax professionals or investment advisors. For personalized advice tailored to your unique financial situation, consult with a qualified tax professional, financial advisor, or attorney.

STILL WANT MORE?

How to Get a Deep Dive?

Want honest feedback on your investment strategy? Submit your portfolio or question to Shrewd Investor and get expert insights in our weekly 'DEEP DIVE' feature.

How was the newsletter? |