- Shrewd Investor

- Posts

- 💸 #0046 - The Rotation Nobody’s Talking About

💸 #0046 - The Rotation Nobody’s Talking About

Rotations are won by those who prepare—not react. This playbook shows how the pros do it.

⚡ LIGHTNING ROUND

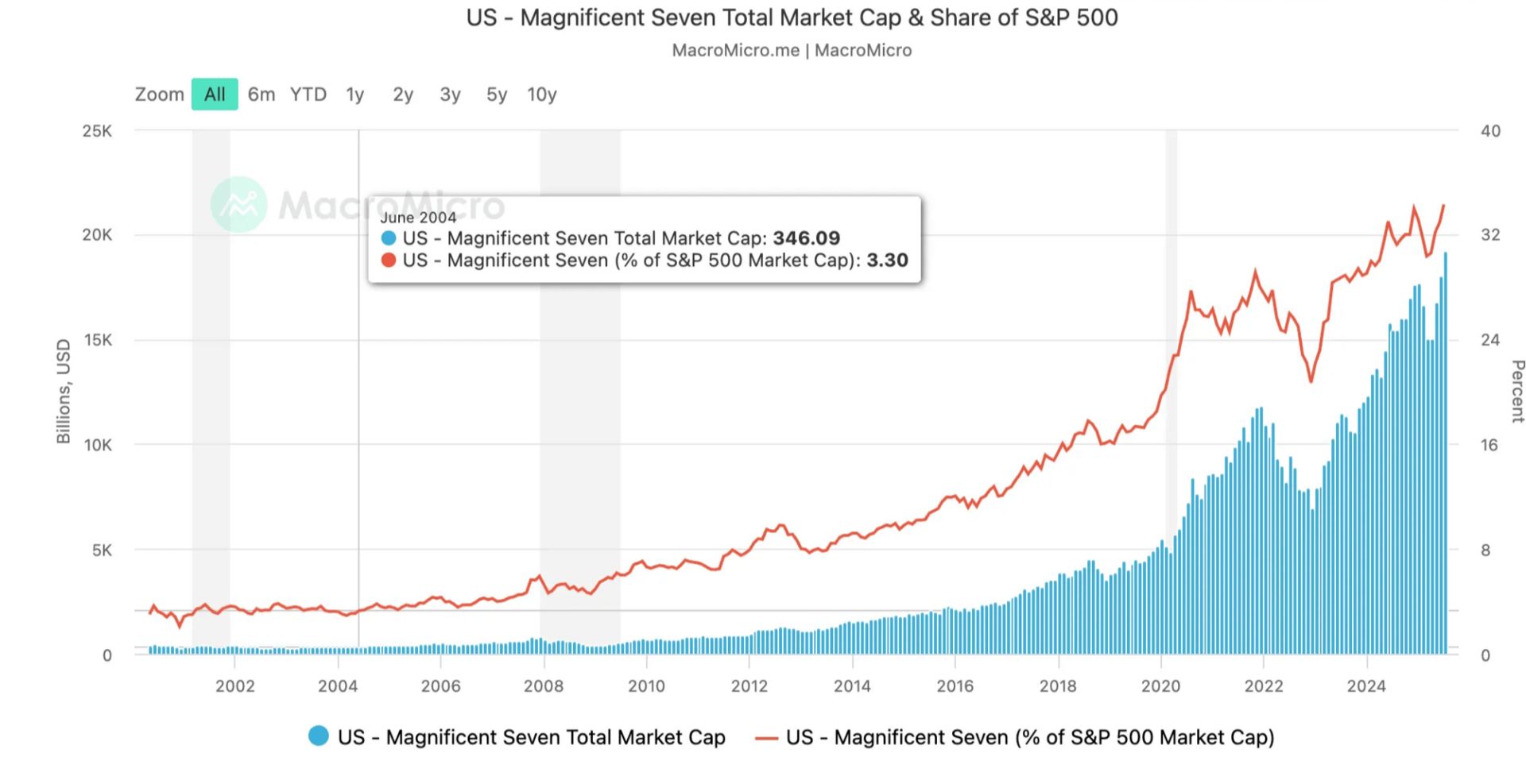

📊 Index Check: Mag7 is now 39% of the S&P 500—the highest concentration in decades. Historically signals fragility.

📈 Valuation Stretch: Growth P/E is nearly 2x value P/E. We’re not at the tipping point yet—but close.

🟠 Earnings Watch: Early signs show the rest of the S&P is catching up in profit growth. Not confirmed, but worth tracking.

📉 Tech Sentiment: Some big tech names are beating earnings… and falling anyway. That’s classic late-cycle behavior.

🧠 Smart Money Move: Don’t rotate yet. But set alerts for:

RSP vs SPY outperformance

QQQ RSI >70

Steepening yield curve

AI-driven gains in non-tech sectors

WEEKLY WISDOM

"There are decades when nothing happens; and there are weeks when decades happen."

MARKET ALERT

You’ve seen the headlines.

The Magnificent Seven—Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla—have dominated the S&P for the last two years.

They delivered eye-popping gains while the rest of the market sat quietly on the sidelines.

But in 2025, the story’s starting to change.

Nvidia is still climbing. Apple’s down double digits. As a group, the Mag7 is now 39% of the S&P 500 index.

It’s not time to panic. But it is time to pay attention.

History Points to What Happens Next

This isn’t new.

We saw it with the Nifty Fifty in the '70s. Again during the Dot-Com Bubble. A handful of stocks pull the market higher… until they stop.

Then, value stocks and equal-weighted portfolios quietly take over. And those who rotated early often profited over the following years.

Are we there yet? Not quite.

But we’re watching closely—and you should too.

✅ The Shrewd Rotation Watchlist

Here’s what we’re tracking. These signals tend to show up before market leadership flips:

1. Concentration Check

What to watch: Top 10 stocks over 30%+ of S&P 500

✅ Already happened.

Why it matters: Market concentration at this level often signals fragility.

2. Valuation Spread

What to watch: Growth stock P/E > 2x Value stock P/E

⚠️ We’re near that level.

Why it matters: Signals stretched sentiment. Historically precedes rotation.

3. Earnings Inflection

What to watch: S&P 493 starts posting stronger earnings growth than the Mag7

🟡 Too early to confirm.

Why it matters: It tells you where future capital may flow.

4. Momentum Shifts

What to watch:

Equal-weight (RSP) outperforms cap-weight (SPY) for 2+ months

RSI >70 on growth ETFs like QQQ

🟡 Not there yet.

Why it matters: Smart money starts reallocating before the trend becomes obvious.

5. Macro Tailwinds

What to watch:

Fed pauses or cuts rates

🟡 Yield curve still inverted, but rate cuts are expected.

Why it matters: These moves historically benefit value sectors—especially banks, energy, and industrials.

6. Earnings Reaction

What to watch: Big tech beats earnings… and the stock still falls

✅ Starting to see this.

Why it matters: Suggests the trade is crowded. Even good news isn’t enough.

7. AI Adoption Broadens

What to watch: Profit growth in non-tech sectors from AI (healthcare, finance, logistics)

🟡 In early stages now.

Why it matters: AI is moving beyond the Mag7. That’s where the next wave of returns may come from.

8. Inflation + Policy Risks

What to watch:

CPI moves higher (especially via alternative data like Truflation)

Trade war/tariff headlines

⚠️ Tariff chatter is growing. Inflation is mixed but sticky.

Why it matters: These shocks tend to hurt tech more than value.

Bottom Line

The trend hasn’t fully flipped. But several leading indicators are starting to line up.

Smart investors are preparing.

🧭 What I’d Do This Week

Review portfolio exposure to large-cap tech

Set alerts for QQQ RSI >70

Monitor RSP vs SPY performance

Keep an eye on rate cuts, earnings surprises, and AI headlines in non-tech sectors

When 3–4 of these signals turn green, that’s the moment to start rotating.

P.S. If you’d like us to break down your portfolio or ask a question, submit yours here: https://shrewdinvestor.com/roastme

If you are interested in sponsoring a future issue, send an email to: [email protected]

How do you like this sectionof this month's issue? |

The content provided in this newsletter is for informational purposes only and should not be considered as specific advice for any specific individual. The information is prepared by knowledgeable individuals and is not written by certified tax professionals or investment advisors. For personalized advice tailored to your unique financial situation, consult with a qualified tax professional, financial advisor, or attorney.

STILL WANT MORE?

How to Get a Deep Dive?

Want honest feedback on your investment strategy? Submit your portfolio or question to Shrewd Investor and get expert insights in our weekly 'DEEP DIVE' feature.

Ready for More Shrewd Investor?

Join us on Friday’s at noon MT for our weekly office hours, where we’ll discuss strategies like these…

👉 Reply with the words OFFICE HOURS to get the link…

How was the newsletter? |